Our Services

Our service offerings include corporate governance training, design and evaluation in the following areas:

The board of directors of a company is at the apex of its internal governance mechanisms. The roles and responsibilities of the board in enhancing a firm’s performance is fairly well established. To ensure boards remain effective and focused on the value maximisation objective of their companies, we assist companies with:

- Examining various aspects of the board dynamics including board charter, board leadership, board composition, board independence, board size, board diversity, board meetings, and board committees, relating each of these to the effectiveness of the board towards enhancing Company’s performance.

- Providing guidance on how best to document board papers, board policies, and board processes, and monitor strategy implementation.

- Conducting Peer-to-Peer assessment of individual board members to identify their strengths and weaknesses relative to the required skills, knowledge and other parameters.

- Organising relevant training for directors to help improve their understanding of a director’s fiduciary roles and the consequences of failure on the board and individual directors.

- Assessing board committees’ effectiveness in their oversight and advisory responsibilities.

- Evaluating the board’s effectiveness in providing monitoring and strategic advisory to the management.

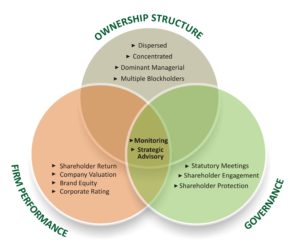

The ownership structure of a company has a telling effect on the overall governance of the company, and therefore, on the performance/valuation of the company. Given the divergence regarding the impact of ownership structure on firm performance particularly in emerging economies, our ownership governance advisory will speak directly to firm specific ownership governance issues. We undertake to help companies with:

- Evaluating their ownership structure.

- Assessing the impact of ownership structure on firm performance, corporate valuation, corporate rating, and brand equity, amongst others.

- Aligning ownership structure with the firm’s objective of value maximisation.

- Developing shareholder protection and shareholder engagement strategies.

- Hamonizing board governance and ownership governance structures consistent with the value maximisation objective of the Company.

We define family business as a company in which a family has voting majority or exercises controlling rights on account of founder-status, and where the founder intends to pass business on to his/her descendants. Family ownership of business is prevalent in most parts of the world, contributing significantly to economic growth and development of nations. However, family businesses face distinctive governance risks, which can be exacerbated if not managed. Our family business governance advisory seeks to manage the related risks in family businesses focusing on three main objectives:

- Preservation and value maximisation of family wealth over generations;

- Transition from founder-owner manager/succession in family businesses; and,

- Promotion of institutional arrangements that create convergence of interests between internal stakeholders (family shareholders, family board members, and family top management staff) and external stakeholders.

- Establishing formal communication channels to allow for proper dissemination of information amongst family members, including those holding management positions in the company and those not in the employment of the company.

- Setting up appropriate institutional arrangements to ensure long-term sustainability and generational transfer of wealth whilst reducing potential rift within the family as well as enhancing filial trust and bond, including:

- Family Constitution that will help clearly define family’s vision, mission, core values, policies, and processes to guide relationships amongst family members

- Family Council that will help entrench the propositions contained in the Family Constitution, and,

- Family Advisory Board that will adopt sustainable business practices by prioritising the “theory of competitive advantage” over the “theory of private benefits”.

- Creating a succession and family employment plan

- Bringing professionalism and objectivity to the process, and documentation of agreements reached.

Risk-taking is natural to businesses and the driving force for entrepreneurs. However, there is an optimal risk level that protects the interest of various stakeholders, which companies should strive to achieve. But companies with weak risk governance are prone to excessive risk-taking. We define risk governance as the application of the principles of good corporate governance to the identification, evaluation, management and reporting of risks. Our intervention will be structured to strengthen the important role of the board in shaping companies’ risk management framework as well as the roles played by the risk management team, internal control unit and business units. We emphasise the importance of a sound risk culture in creating a prudent risk-taking environment.

Accordingly, we assist companies in:- Designing risk management system to enhance risk information disclosure, risk monitoring, risk measurement, compliance, and appropriate reporting

- Examining the effectiveness of the risk management systems and practices.

- Evaluating whether current and future risk-exposure is consistent with a company’s risk appetite and tolerance level.

- Designing executive remuneration structure to be consistent with the shareholder value maximisation and other stakeholders objective, while promoting prudent risk-taking.

- Assessing the rubrics of the Company’s Enterprise Risk Management (ERM)

- Integrating risk governance structures including the board and relevant board committees into the overall corporate governance regime.

- Organising risk management training for boards and senior management teams.

Merger and acquisition decisions are some of the most important that boards make. Directors should ensure M&A decisions have synergistic effect leading to shareholder value maximisation, which would be the case if a good M&A decision is made. On the other hand, a bad M&A decision can be value-destroying. M&A decisions and processes can be particularly demanding for board members, and so require board oversight through the pre, during, and post-merger phases. Directors, therefore, need to be diligent and dedicate time to the process as their decisions to approve or reject deal proposals are subject to the scrutiny of shareholders and other stakeholders. But directors may be challenged, lacking in the requisite skills to critically review M&A proposals, dedication of enough time, and potential conflict of interest as directors’ objectivity may be impaired because they stand the risk of losing board seats. The M&A process could be a stress test for boards given the potential legal and reputational risks that directors face for breaches and or other alleged transgressions. While the board and investment bankers are pushing for deal closure with limited emphasis on the governance issues, our M&A governance advisory seeks to assist companies with:

- Creating an M&A governance framework for board members to guide them through the M&A decision-making process.

- Getting the board, M&A committee and investment bankers to pay deeper attention to governance issues throughout the deal process.

- Conducting governance due diligence and analysing potential mergers, acquisitions, investments, or divestitures from a governance perspective.

- Dealing with potential regulatory risk resulting from M&A.

- Supporting M&A committee oversight function to ensure the company’s M&A strategy is consistent with its objectives.

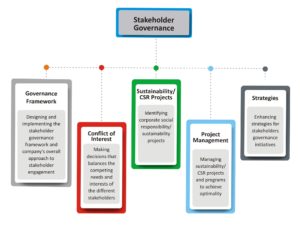

Our other service offerings have emphasized value maximisation from shareholders’ perspective as the underlying pristine philosophy. However, our stakeholder governance advisory takes a more inclusive approach, which extends beyond shareholders, taking into account the interest of others that, in the broadest sense, includes the larger society. Essentially, the emphasis shifts from strong shareholder value maximisation to stakeholder value harmonization. We seek to entrench an organisational environment and managerial behaviour that value reliability, transparency, accountability, fairness, solidarity, and justice over quick shareholder returns in the interest of other stakeholders.

- Designing and implementing the stakeholder governance framework for companies in a way that will help shape the company’s overall approach to stakeholder engagement.

- Making decisions that balance the competing needs and interests of the different stakeholders

- Identifying corporate social responsibility/sustainability projects.

- Managing the projects and programs to achieve cost economy.

- Enhancing strategies for stakeholders governance initiatives.

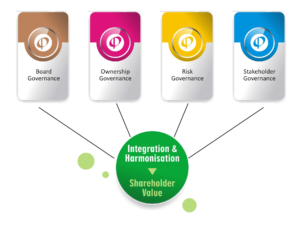

Our Corporate Governance Evaluation advisory is designed to help strengthen companies by developing or improving their overall corporate governance framework and thereby enhancing their growth and long-term sustainability. Our corporate governance evaluation advisory requires us to:

- Combine and integrate our other service offerings including board, ownership, risk, and stakeholder governances, as would be appropriate, into the corporate governance evaluation equation.

- Review the compensation systems to ensure it is an integral part of the governance and incentive structure through which the board and senior management of a company define acceptable risk-taking behaviour and reinforce the company’s risk culture.

- Assess the company’s current corporate governance framework and practices against internationally-accepted benchmarks and best practices to identify weaknesses and gaps.

- Make recommendations to address and close the weaknesses and gaps.

- Help with the implementation of recommendations to ensure the right governance structures are in place and are continually improved on.

- Provide training on board dynamics, organizational structure, strategy, internal controls, risk management, compliance, and stakeholder engagement, amongst others.

- Provide guidance on how to conduct in-house corporate governance evaluation.

Consistent with our corporate mission, our service offerings seek to provide a robust corporate governance framework that will put companies on the path of sustainable growth, meet regulatory requirements, harmonise stakeholders’ perspective in which shareholder value maximisation objective is pursued while taking into account other stakeholders, and consequently support the economic development of the Country

Address:

3rd & 4th Floor St Peter’s House,

3 Ajele Street Off Broad St.

Lagos.

Tel: +234-01-2702296

Email: info@planetcapitalltd.com

© 2018 Planet Capital Ltd. All Rights Reserved.